Dear friend,

GP AuditWorld Ltd is an international audit, tax planning, corporate service and business

consulting firm with specialized qualified accountants and auditors from universities in the US,

Greece, and the UK, with keen knowledge and practical experience in their specializations

providing audit, comprehensive tax, corporate and business consulting services to foreign and

local businesses or individuals investing in Cyprus or internationally.

Our broad client base, coupled with our many years’ cumulative experience has allowed our firm

to nurture the specialized professional expertise critical to success, which encompasses a

dedicated client focus and a unique understanding of Cypriot and international business

practices. Above all, our clients are assured of a high level of professional service and focused

attention to their Cypriot business and investment needs.

Investors in today’s complex economic, legal and tax environment, require their advisors to

possess broad-based consulting skills, as well as hands-on experience and knowledge of all

relevant aspects of tax, accounting and operational issues. GP Auditworld’s unique approach to

problem solving employs multivariate analysis to business problems and opportunities, enabling

us to develop creative alternatives and sound recommendations towards achievement of our

clients’ goals.

The publication of Tax Insider 2019 is part of our effort to continuously update our clients and

friends for any changes in key tax issues in Cyprus. Tax Insider 2019 presents information of

general nature which is not intended to address the circumstances of any individual or entity.

You should not act on such information without appropriate professional advice after a thorough

examination of the situation. If you have any questions or concerns regarding your Cypriot

investments or with the information provided with the Tax Insider 2019, please contact us at

your convenience to discuss them.

Best Regards

George Pitziolis

Director

TAX INSIDER 2019

Personal Income Tax

Individuals who spend more than 183 days in one calendar year in Cyprus are consider tax

residents of Cyprus. Days in and out of Cyprus are calculated as indicated below:

- The day of an individual arrives in Cyprus counts as a day of residence in Cyprus

- The day of an individual departures outside of Cyprus counts as a day of residence

outside Cyprus

- If an individual arrives and departs Cyprus in the same day counts as one day of

residence in Cyprus

- If an individual departs and arrives Cyprus in the same day counts as one day of

residence outside Cyprus.

In a case where foreign taxes are paid by an individual and the same individual is Cyprus

Tax resident under the residency test then credit can be claimed against the personal tax

liability in Cyprus.

Personal tax rates

The effective tax rates for the year 2019 are;

Income

€ |

Tax Rate

% |

Tax Amount

€ |

Commulative Tax

€ |

| 0-19,5000 |

0 |

- |

- |

| 19,501-28,000 |

20 |

1.700 |

1.700 |

| 28,001-36,300 |

25 |

2.075 |

3.775 |

| 36,301-60,000 |

30 |

7.110 |

10.885 |

| Over 60,000 |

35 |

|

|

In cases of foreign pension income is taxed at the flat rate of 5%. An annual exception of

€3,420 is granted. The taxpayer in this category is allowed to elect to be taxed at the

normal tax rates as showed above. The choice can be made from year to year according

to the taxpayer’s choice.

Special Contribution

Special Contribution for a period of three years (1/1/2014-31/12/2016)

A special contribution on gross income for the period mentioned above is

imposed pensioners and self-employed individuals and employees (50% of the tax

contributed by the employer) in the private sector. The special contribution tax is

calculated based on the following table.

Income

€ |

Contribution

% |

Cumulative tax

€ |

| 0-1,500 |

0 |

- |

| 1,501-2,500* |

2.5 |

25 |

| 2,501-3,500 |

3 |

55 |

| Over 3,500 |

3.5 |

|

| Over 60,000 |

|

|

* There is a minimum amount of special contribution of €10

Exemptions

Tax Exemptions for Individuals are presented in the table below

| Dividend Income |

100% |

Interest Income, except for interest arising from the

ordinary business activities, or it is related directlly to

the ordinary business activities of an individual |

100% |

|

Profits from sale of securities as shares, bonds,

debentures etc.

|

100% |

|

Capital sums accruing to individuals from life

insurance plans (under certain conditions) or approved

provident funds

|

100% |

|

Foreign Pension

|

€3,420 |

|

Rent in relation to buildings which there is a

Preservation Order (under certain conditions)

|

100% |

|

Remuneration from salaried services rendered outside

Cyprus for more than 90 days in a tax year to a non-

Cyprus resident employer or to a foreign pernament

establishment of a Cyprus resident employer

|

100% |

|

Profits from a pernament establishment abroad (under

certain conditions)

|

100% |

|

Lump sum received by way of retiring qratuity,

commutation of pension or compensation for deat or

injuries

|

100% |

|

Remuneration from any office or employment of an

individual provided that s/he was not resident of

Cyprus before employment (applicable for 5 years

commencing from the 1st of January following the year

of the employment)

|

20% of the

remuneration with

a maximum

amount of €8,550

annually |

|

Remuneration from any employment exercised in

Cyprus by an individual who was not a resident of

Cyprus before the commencement of the employment,

exemption applies for a period of 10 years for

employments commencing as of 1 January 2012

provided the the annual remuneration exceeds

€100,000

|

50% of the

remuneration |

Tax Deductions

| Contributions to trade unions or professional bodies |

100% |

| Special contribution |

100% |

|

Deduction for annual life insurance premiums,

Provident funds(under certain conditions), Pensions,

contributions to the General Medical Fund and

contributions to foreign funds (under certain

conditions)

|

Up to 1/6 of the

taxable income |

|

Rental Income

|

20% rental

Income minus

loan interest and

wear and tear

allowance |

|

Donation to approved charities (with receipts)

|

100% |

|

Losses of previous and current five years (in cases of

audited financial statements)

|

100% |

|

Remuneration from salaried services rendered outside

Cyprus for more than 90 days in a tax year to a non-

Cyprus resident employer or to a foreign pernament

establishment of a Cyprus resident employer

|

100% |

|

Deduction for expenditure for a building in respect of

which there is in force a Preservation Order as per the

table below

|

|

|

EUR €

|

Per m2 |

|

1.200

|

1-120 |

|

1.100

|

121-1,000 |

|

700

|

1,001-over |

Directors and Shareholder’s loans

If a company grants a loan or other financial assistance to its directors or shareholders

up to their 2

nd degree relatives who are physical persons, then the recipient is deemed to

have a monthly benefit of 9% per year calculated on a monthly basis and is assessed

and collected via the PAYE (pay as you earn) system.

Child benefit

Annual Family

Income € |

Family

with 1

child

€ |

Family

with 2

children*

€ |

Family

with 3

children*

€ |

Family

with 4

children*

€ |

| 0-19,500 |

475 |

570 |

1045 |

1675 |

| 19,501-39,000 |

425 |

520 |

995 |

1525 |

| 39,001-49,000 |

380 |

380 |

760 |

1260 |

| 49,001-59,00 |

0 |

348 |

690 |

1135 |

* Per child

* Amounts are based on previous year family’s income

For single parent families an allowance is granted based on the family’s annual income

| Annual Family Income |

Monthly Allowance for each

independent student |

| € |

€ |

| 0-39,000 |

180 |

| 39,000.01- 49,000 |

160 |

Preparation of financial statements

From tax year 2006 and after, sole proprietors with annual turnover of more than

€70,000 are obligated to prepare audited financial statements

Corporation Tax

The corporation tax for all companies including Semi Governmental Organizations is

12.5%

Tax Deduction for companies are presented in the table below.

Employer's contribution on salaries such as social

insurance and approved funds |

100% |

| Expenses for business entertainment |

1% of gross

income

(max €17,086) |

Subscriptions and donations to approved charities with

receipts |

100% |

All expenses used for production of income under

centain conditions |

100% |

| Royalty income |

80% |

Net profit from the disposal of intellectual property

under certain conditions |

80% |

| Amortization of the Cost of Aquizition |

20% |

| Amortization of the development of intagible asset |

20% |

For the period 2012-2014 accelarated depreciation on

buildings |

7% |

For the period 2012-2014 accelarated depreciation for

plant and machinery |

20% |

Interest expense incurred for the acquisition after

1.1.12, of the share capital of a subsidiary company

when the participation in the subsidiary is 100%

directly or indirectly. |

100% |

The term intangible assets refer to copyrights, patents and trademarks

Deductions can not be claimed for expenses and interest of a private motor vehicle

Tax Exceptions for companies are presented in the table below

| Income from dividends |

100% |

| Profit from the sale of securities |

100% |

Under certain conditions profits of a pernament

establishment abroad |

100% |

Interest income not accruing or closely connected

with the ordinary activities of the company |

100% |

Tax Incentives

Losses carried forward

Tax loss incurred during a tax year can be set off against future profits for the next five

years.

Group Relief

Tax loss of a company can be set off against the profit of another company which part of

a group and is Cyprus tax resident. Group is defined as follows

- One company holding the minimum of 75% of the voting shares of the other

company, or,

- Both of the companies are at least 75% held by another third party

Reorganizations

Companies’ reorganizations are allowable without any tax effect under certain

conditions. Reorganizations include

- Demergers

- Partial divisions

- Mergers

- Transfer of assets

- Exchange shares

Annual wear and tear allowances on tangible fixed assets

| Plant and machinery |

10.00% |

| Furniture and fittings |

10.00% |

| Industrial carpet |

10.00% |

| Boreholes |

10.00% |

| Machinery and tools used in agricultural business |

15.00% |

| Buildings |

% |

| Commercial buildings |

3.00% |

| Industrial agricultural and hotel buildings |

4.00% |

| Flats |

3.00% |

| Metallic greenhouse structures |

10.00% |

| Wooden greenhouse structure |

33.33% |

| Vehicles and Means of Trasportation |

% |

| Commercial motor vechicles |

20.00% |

| Motor Cycles |

20.00% |

Excavators, tractors,bulldozers,self-propelled loaders

and drums for petrol companies |

25.00% |

| Armoured Motor Vechicles |

20.00% |

| Speciallised Machinery for the laying or Railroads |

20.00% |

| New Airplanes |

8.00% |

| New Helicopters |

8.00% |

| Sailing vessels |

4.50% |

| Motor Yachts |

6.00% |

| Steamers,tugs and fishing boats |

6.00% |

| Shipmotor launchers |

12.50% |

| New cargo vessels |

8.00% |

| New passenger vessels |

6.00% |

| Used cargo/passenger vessels |

Over their useful

lives |

| Other |

% |

| Televisions and videos |

10.00% |

| Computer hardware and operating systems |

20.00% |

| Application Software |

33.33% |

Expenditure on application software less than €1,709

is written off in the year of acquisition |

|

| Wind Pawer Generators |

10.00% |

| Photovoltaic Systems |

10.00% |

| Tools in general |

33.33% |

| Videotapes property of video clubs |

50.00% |

Social Insurance

Rates

| Employer's contributions |

8.30% |

| Employee contributions |

8.30% |

| Self-employed contributions |

15.60% |

Contributions to social insurance are restricted to the maximum level of annual income

as listed below

|

€ |

Per annum € |

| Weekly employees |

1,051 |

54,648 |

| Monthly employees |

4,554 |

|

Other Employers Contributions are listed in the table below

|

Employer's contribution |

| Social Cohesion Fund |

2,00% |

| Redundancy Fund |

1,20% |

| Industrial Training Fund |

0,50% |

| Annual Leave Fund |

8,00% |

Capital Gains Tax

Any gain arising after the deduction of sales proceeds, of the value of the property at

1.1.1980 or the cost of acquisition after 1.1.1980 adjusted to account for inflation is taxed

at a flat rate of 20%. Lifetime exceptions are listed in the table below.

|

Gain up to € |

| Any disposal |

17.086 |

| Disposal of Agricultural land |

25.629 |

| Disposal of private residence |

85.430 |

It is important to note that gains accruing from disposal of property held outside the

Republic are exempted from capital gains tax.

Land Transfer Fees

Land transfer tax rates are listed below

| Value |

Tax Rate % |

Transfer fees € |

Cumulative € |

| Up to €85,000 |

3 |

2.550 |

2550 |

| 85,001-170,000 |

5 |

4.250 |

6800 |

| Over 170,000 |

8 |

|

|

Immovable Property Tax

Property owners whose total property is less than €12,500 are exempt from paying

property tax. If the value of the property at 1.1.1980 is more than the exempt amount

mentioned above the property tax can be calculated based on the following table

Value of property

1,1,1980 € |

Rate % |

Cumulative € |

| Up to 40,000 |

0,6% (min € 75) |

240 |

| 40,001-120,000 |

0,8 |

880 |

| 120,001-170,000 |

0,9 |

1330 |

| 170,001-300,000 |

1,1 |

2760 |

| 300,001-500,000 |

1,3 |

5360 |

| 500,001-800,000 |

1,5 |

9860 |

| 800,001-3,000,000 |

1,7 |

47260 |

| Over 3,000,000 |

1,9 |

|

Special Contribution to the Defense Fund

| Type of Income |

Rates |

| Interest Income |

30,00% |

| Interest Income Received by Provident Funds |

3,00% |

| Rental Income Minus 25% |

3,00% |

| Foreign Dividend Income (Certain Conditions) |

17,00% |

| For individuals only |

Rates |

| Interest from Government Development Bonds |

3,00% |

| Interest with Income Less Than €12,000 |

3,00% |

| Dividends Received by Individuals Residents of the Republic |

17,00% |

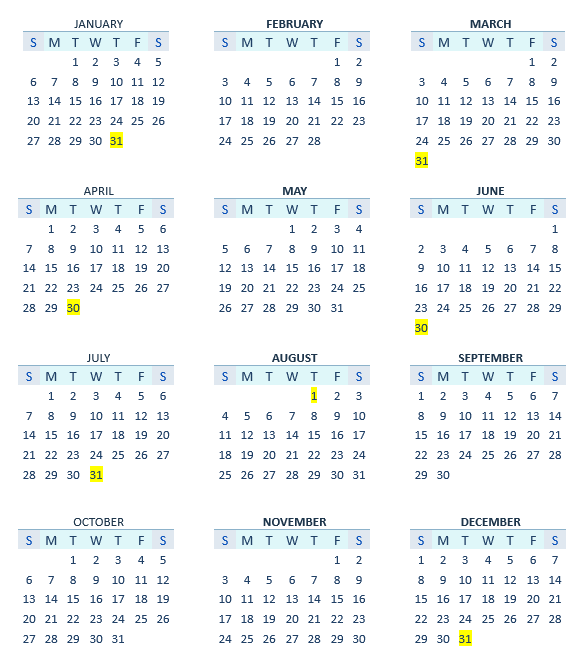

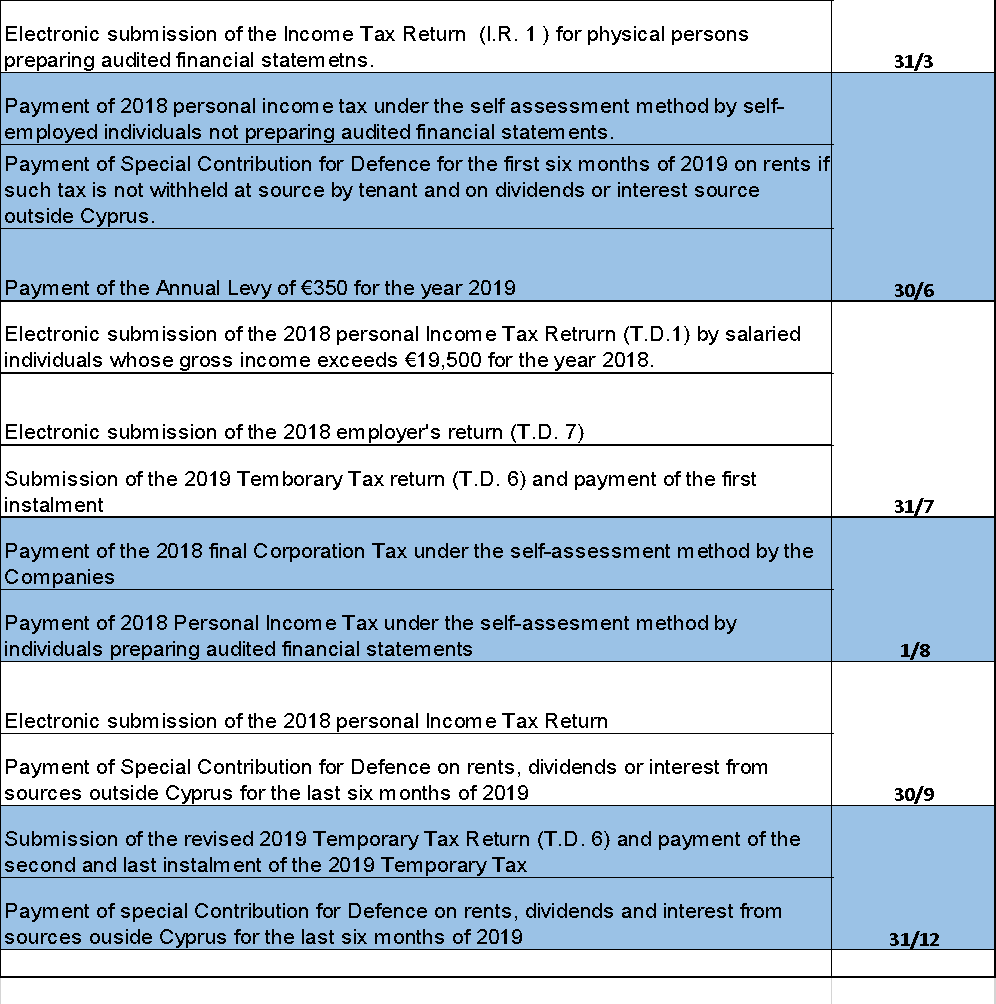

Important Tax Dates

- 31/1- Submission of declaration of deemed dividend distribution (TD623) for the year ended 2016.

- 31/3- Electronic submission of 2017 corporate tax return (TD4) for accounting periods ending on 31 December 2017 (TD4).

Electronic submission of the 2017 income tax return of physical persons preparing audited financial statements.

- 30/4- Payment of premium tax for life insurance companies – first instalment for 2019.

- 30/6- Payment of special contribution for defence for the first six months of 2019 on rents if such ta is not withheld at source by tenant and on dividends or interest from sources outside Cyprus.

Payment of 2018personal income tax under the self-assessment method by self-employed individuals not preparing audited financial statements.

- 31/7- Electronic submission by employers of the total 2018 payroll (Form TD7).

Submission of the 2019 provisional income tax return and payment of the first instalment.

Electronic submission of 2018 person income tax returns and payment of 2018 personal income tax under the self-assessment of/by employees and pensioners, whose incomes do not include income from a trade/business, rents, dividends, interest, royalties nor income relating to trading goodwill.

- 1/8- Payment of 2018 final corporation tax under the self-assessment method.

Payment of 2018 personal income tax under the self-assessment method by self-employed individuals preparing audited financial statements.

- 31/8- Payment of premium tax for life insurance companies – second instalment for 2019.

- 30/9- Electronic submission of 2018 personal ta returns of self-employed individuals not required to prepare audited financial statements.

- 31/12- Payment of provisional tax – second and last instalment for 2019.

Payment of special contribution for defence for the last six months of 2019 on rents if such tax is not withheld at source by tenant and on dividends or interest from sources outside Cyprus.

Payment of premium tax for life insurance companies – third and last instalment for 2019.

At the end of each following month the following are due:

- Payment of income tax deducted from employee’s salary (PAYE)

- Payment of Special Contribution for Defense withheld on payments of dividends, interest and rents made by companies, partnerships, the State or local authorities, made by Cypriot tax residents.

- Payment of tax withheld on payments to non-Cypriot tax residents.

In case that the above deadlines are not med, then an annual interest of 4% is charged as well as a penalty depending on the circumstances.

Value Added Tax (VAT)

The Vat tax rates are listed below

| Standard VAT Rate (up to February 29 2012) |

15,00% |

| Standard VAT Rate (from 1 March 2013 to 13 January 2013) |

17,00% |

| Standard VAT Rate (from 14 January 2013 to 12 January 2014) |

18,00% |

| Standard VAT Rate (from 13 January 2014 onwards) |

19,00% |

| Reduced VAT Rate (Restaurant, Catering, etc) |

8,00% |

| Reduced VAT Rate (Restaurant, Catering, etc) from 13 January 2014 onwards |

9,00% |

| Reduced VAT Rate (Foodstuffs, Medice, etc) |

5,00% |

| Sale or Construction of New Residential Properties |

5,00% |

| Zero Rate (Export of Goods, Leasing of Aircraft and Vessels) |

0,00% |

Special VAT reliefs on the importation of certain categories of aircraft and a new scheme covering the lease of pleasure boats in Cyprus

VAT registration threshold

| Cases |

Registration Threshold |

| € |

€ |

| Supply of goods and services within the Republic |

15,600 |

|

Supply of goods and services to persons established in other

member states where they do not hold a valid VAT number

|

15,600 |

|

Supply of goods and services to persons established in other

member states where they hold a valid VAT number

|

N/A |

|

Services from non Cypriot suppliers and holding companies if

their involved in economic activities

|

15,600 |

|

Goods in the Republic from other Member States by individuals

or organizations involved with exempt activities (educational istitutions and hospitals)

|

10,252 |

|

Distance sales from person established in other Member State to

individuals or non-VAT registered persons within the Republic

|

35,000 |

The registration with the Cyprus VAT creates liabilities depending on the circumstances as follows

- Submission of VAT return per month or per quarter

- Issue of VAT invoices to VAT registered persons or organizations with the right to claim input VAT

- Issue of legal receipts to individuals or non-VAT registered persons for the taxable supply of goods or services or the provisional services with affect from 16 January 2012

- VIES statement every month for dispatches of goods with destination to other Member States

- Intrastat statements for dispatches every month for goods to other Member States provided that the other party has a valid VAT number. For the year 2014 the registration threshold is €55,000

- Intrastat statement for arrivals every month for purchasing of goods from other Member States provided that the other party has a valid VAT number. For the year 2014 the registration threshold is €100,000

- Within 60 days from the termination of trading operation deregistration from the Cyprus VAT Register is required.

The following penalties for non-compliance with the Cyprus VAT regulation are in place

- Failure to registered with the Cyprus VAT €85 per month

- Delayed of the VAT return €51 per vat return

- Delayed of payment of output VAT €10% one-off penalty and 4.5% annual interest

- Delayed of registration with the VIES system €50 per VIES Statement, of VIES Statement €50 per statement, of correction of VIES statements €15 per statement and delayed of submit VIES statements which is also a criminal offence €850 per statement.

- Delayed of registration with the INTRASTAT declarations €15 per INTRASTAT Return, of submission of INTRASTAT declarations €15 per INTRASTAT Return, of correction of INTRASTAT declaration €15 per return, failure to submit INTRASTAT returns is a criminal offence and delayed of deregistration from the Cyprus VAT Register €85 one-off penalty.